5 Key Performance Indicators Business Owners Should Monitor For Growth

by Leanne Mordue on 02-Oct-2023 12:00:00

Monitoring key performance indicators (KPI) is an important element of tracking and driving company growth. In this article, we will look at five essential and quantifiable metrics that SME business owners should keep an eye on when planning expenditure on marketing and sales, discussing the significance of each metric, how to measure it effectively, how often to monitor, and how to interpret the data to make better-informed decisions.

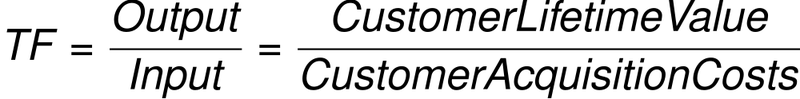

1. Customer Acquisition Cost (CAC)

Your customer acquisition cost is how much money is required to make each sale. To maximise your margins and ROI, it is crucial to understand the effectiveness of your marketing and sales efforts, recognise your sales overheads, and which channels are the most profitable and efficient, and continually optimise your strategy accordingly.

How To Measure

Customer acquisition cost can be calculated by dividing your total sales and marketing expenditure by the total number of newly acquired customers during a specific period, e.g., quarterly, annually, or monthly.

CAC Per Sales Period = (Total marketing and sales expenditure) / (Number of new customers)

e.g.,

CAC Per Year = £12,000 / 16

= £750

Monitoring And Interpretation

AC should be monitored on a monthly or quarterly basis during an active marketing campaign, and annually at other times, comparing your figures to industry benchmarks and your historical sales data. If your acquisition costs increase, it might be necessary to reassess and adjust your marketing and sales tactics or explore more cost-effective or high-yielding channels.

2. Average Value Per Sale

Your average sales value indicates how much each customer contributes to your company’s coffers with each purchase, allowing you to optimise your customer acquisition costs and marketing tactics.

How To Measure

To calculate average sales value, divide your total sales revenues by the total number of purchases during a specified sales period. You may wish to divide this KPI into separate averages for new and existing customers if, for instance, new customers generally spend less than repeat customers.

Average Value = (Total annual sales revenues) / (Total purchases)

e.g., £560,000 PA / 77 purchases

= £7,273 average value

Interpretation And Monitoring

Ideally, your average sales value should be measured annually or quarterly. If your average value is lower than expected, you may wish to consider implementing upselling or cross-selling strategies or refining your pricing strategy. However, the average value is only really useful for businesses whose sales value is fairly consistent across their customer base. If your business derives most of its sales revenue from a small number of valuable purchases, with the majority of purchases being low value, you’re better off looking at the value gap between the lowest and highest values and investigating strategies to reduce this gap.

3. Customer Lifetime Value (CLTV)

The lifetime value of each customer represents the total revenue your business can expect to generate from a single customer throughout your business relationship. This metric is useful for several reasons, including helping you determine how much you should invest in acquiring and retaining customers.

How To Measure

To calculate CLTV, multiply the average purchase value, your average purchase frequency rate over a specified sales period (usually per year), and the average customer lifespan (years).

CLTV = (Average purchase value) x (Average purchase frequency) x (Average customer lifespan in years)

e.g.,

CLTV = £500 x 6(p/a) x 12 (years)

= £36,000

Monitoring And Interpretation

By definition, CLTV is an extremely crude metric, as it discounts any changes in average purchase frequency and value, e.g., due to upselling, cross-selling etc., and also ignores any price changes across the customer lifespan. Despite this, it is a central metric to consider when establishing your sales and marketing budget and making ROI calculations. It’s wise to monitor CLTV on a regular basis, focusing on trends and comparisons within your sector, and considering strategies to improve CLTV where necessary, including customer retention measures, upsell opportunities, and customer satisfaction initiatives.

4. Conversion Rate

Conversion rates are measures of how successful you are in persuading prospects to complete a desired action, such as downloading an eBook, getting in touch through your website, or purchasing a product. In practice, therefore, conversion rate covers several insightful KPIs, including lead generation, email marketing click-throughs, sales, etc.

How To Measure

Calculating your conversion rate for a particular channel or tactic is straightforward. Simply divide the number of completed actions by the total number of participants during a specified period, for example:

Website Generation Conversion Rate = (Number of email newsletter signups) / (Total number of website visitors per month)

or

eBook Conversion Rate = (Total number of inbound enquiries from the eBook – e.g., through a campaign phone number or email)/ (Number of eBook downloads per month)

or

New Business Sales Conversion Rate = (Total purchases by new customers) / (Total sales qualified leads per quarter)

Monitoring And Interpretation

Measuring your conversion rate at every step of your sales process will help you understand how effectively your sales and marketing initiatives are driving the desired actions, and will highlight areas for improvement. Keep an eye on any changes in conversion rate to determine whether adjustments are needed in your marketing channels, sales messages, or user experience.

5. Turnover Rate

Your customer turnover rate, or ‘churn rate’, measures the percentage of customers that cease doing business with your company within a year, quarter, or other sales period. Closely monitoring your turnover will help you identify customer retention issues and implement strategies to strengthen customer loyalty and value.

How To Measure

Turnover is calculated by dividing the number of customers lost during a sales period by the total number of customers at the beginning of that period.

Turnover = (Number of customers lost) / (Total number of customers at beginning of period) x 100 (To get a percentage)

e.g.,

Annual Turnover = 6 customers lost / 102 total customers x 100

= 5.9%

Monitoring And Interpretation

Benchmarks for turnover rates vary widely between industries and also fluctuate over time in response to market conditions. In general, however, the lower your turnover, the less you’ll have to spend on acquiring new customers, so monitor your own turnover closely compared to industry averages and take prompt action to address any spikes or unexpected increases. This may indicate an opportunity to improve your customer experience, review your pricing strategy, or diversify your product and service portfolio.

Find Out More

Inbound marketing is a data-driven approach to small business sales that provides objective insight into key metrics that help you improve your revenues and reduce your acquisition costs. To find out more, please contact JDR Group today.

Image Source: Canva

- Inbound Marketing (SEO, PPC, Social Media, Video) (832)

- Strategy (368)

- Sales & CRM (197)

- Marketing Automation & Email Marketing (192)

- Business Growth (168)

- Website Design (162)

- Hubspot (141)

- Lead Generation (117)

- Google Adwords (100)

- Content Marketing (94)

- Conversion (53)

- Case Studies (49)

- News (47)

- Ecommerce (39)

- Webinars (36)

- SEO (27)

- AI (21)

- Events (19)

- LinkedIn Advertising (17)

- Video (17)

- Video Selling (15)

- Software training (13)

- Niche business marketing (11)

- The Digital Prosperity Podcast (10)

- Facebook Advertising (8)

- HubSpot Case Studies (7)

- Web Design Case Studies (1)

- February 2026 (9)

- January 2026 (12)

- December 2025 (15)

- November 2025 (6)

- October 2025 (17)

- September 2025 (16)

- August 2025 (14)

- July 2025 (14)

- June 2025 (5)

- May 2025 (19)

- April 2025 (15)

- March 2025 (13)

- February 2025 (13)

- January 2025 (8)

- December 2024 (2)

- November 2024 (4)

- October 2024 (21)

- September 2024 (4)

- August 2024 (8)

- July 2024 (14)

- June 2024 (16)

- May 2024 (25)

- April 2024 (15)

- March 2024 (18)

- February 2024 (5)

- January 2024 (10)

- December 2023 (6)

- November 2023 (10)

- October 2023 (13)

- September 2023 (12)

- August 2023 (14)

- July 2023 (13)

- June 2023 (14)

- May 2023 (15)

- April 2023 (13)

- March 2023 (14)

- February 2023 (13)

- January 2023 (15)

- December 2022 (13)

- November 2022 (6)

- October 2022 (8)

- September 2022 (22)

- August 2022 (15)

- July 2022 (13)

- June 2022 (16)

- May 2022 (14)

- April 2022 (16)

- March 2022 (17)

- February 2022 (11)

- January 2022 (8)

- December 2021 (6)

- November 2021 (7)

- October 2021 (11)

- September 2021 (10)

- August 2021 (7)

- July 2021 (7)

- June 2021 (4)

- May 2021 (4)

- April 2021 (1)

- March 2021 (3)

- February 2021 (5)

- January 2021 (4)

- December 2020 (7)

- November 2020 (6)

- October 2020 (5)

- September 2020 (9)

- August 2020 (18)

- July 2020 (17)

- June 2020 (17)

- May 2020 (10)

- April 2020 (21)

- March 2020 (24)

- February 2020 (21)

- January 2020 (12)

- December 2019 (23)

- November 2019 (12)

- October 2019 (14)

- September 2019 (16)

- August 2019 (15)

- July 2019 (13)

- June 2019 (6)

- May 2019 (8)

- April 2019 (4)

- March 2019 (2)

- February 2019 (2)

- January 2019 (2)

- December 2018 (3)

- November 2018 (24)

- September 2018 (11)

- August 2018 (9)

- June 2018 (3)

- May 2018 (6)

- April 2018 (14)

- March 2018 (12)

- February 2018 (16)

- January 2018 (15)

- December 2017 (15)

- November 2017 (18)

- October 2017 (23)

- September 2017 (19)

- August 2017 (28)

- July 2017 (27)

- June 2017 (25)

- May 2017 (18)

- April 2017 (17)

- March 2017 (16)

- February 2017 (17)

- January 2017 (14)

- December 2016 (21)

- November 2016 (27)

- October 2016 (25)

- September 2016 (16)

- August 2016 (20)

- July 2016 (19)

- June 2016 (14)

- May 2016 (20)

- April 2016 (24)

- March 2016 (22)

- February 2016 (28)

- January 2016 (27)

- December 2015 (28)

- November 2015 (19)

- October 2015 (9)

- September 2015 (12)

- August 2015 (5)

- July 2015 (1)

- June 2015 (10)

- May 2015 (3)

- April 2015 (11)

- March 2015 (14)

- February 2015 (15)

- January 2015 (12)

- December 2014 (2)

- November 2014 (23)

- October 2014 (2)

- September 2014 (2)

- August 2014 (2)

- July 2014 (2)

- June 2014 (7)

- May 2014 (14)

- April 2014 (14)

- March 2014 (7)

- February 2014 (2)

- January 2014 (7)

- December 2013 (9)

- November 2013 (14)

- October 2013 (17)

- September 2013 (3)

- August 2013 (6)

- July 2013 (8)

- June 2013 (4)

- May 2013 (3)

- April 2013 (6)

- March 2013 (6)

- February 2013 (7)

- January 2013 (5)

- December 2012 (3)

- November 2012 (2)

- September 2012 (1)

Subscribe by email

You May Also Like

These Related Blogs

Your Guide to Customer Acquisition Costs & Customer Lifetime Value

Would you like to see the return on your marketing investment? Or evaluate how good your sales team are at upselling existing customers? Or even under …

Growing Against Odds: Addressing Common Growth Challenges For UK Small Businesses

You’re a small business with big ambitions. But despite your obsession with quality, commitment to your customers and incredible team, it seems as tho …

Customer Lifetime Value: Understanding the Key to Sustainable Business Growth

Not all customers are worth the same to your company long term. In order to get the most out of your business, you'll need to understand Customer Life …