Customer Lifetime Value: Understanding the Key to Sustainable Business Growth

by Andy Gibbins on 06-Aug-2020 11:30:00

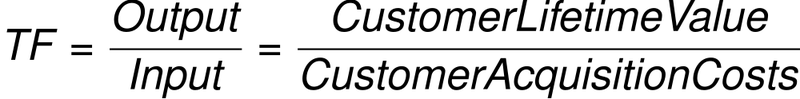

Not all customers are worth the same to your company long term. In order to get the most out of your business, you'll need to understand Customer Lifetime Value (CLTV) and use it to your advantage as you shape your sales and marketing strategies.

What is CLTV?

Customer Lifetime Value, is a metric used to measure how much revenue a single customer account can offer over their full ‘lifetime’ with you. In order to calculate it, there are three essential factors to take into account:

1) The average amount the customer spends per payment period (e.g. monthly, quarterly, annually, or per order),

2) How the average revenue pattern changes over time – e.g. what is the maximum average order value per customer, and how does this reduce or increase?

2) The average customer lifespan, or retention period.

A sophisticated CLTV calculator will see you comparing average purchase value, purchase frequency, and lifespan. This way, you'll be able to see at a glance how valuable each particular customer is to your business. Customer lifespan is particularly important. A single large purchase may give your revenue a short-term boost, but customers with a reliable spending track record are worth far more in the long term. Remember, it costs less to retain a happy customer than it does to court a new one!

A CLTV optimisation strategy should seek to maximise all three metrics; longer retention period, bigger payments and increased upsell.

How to Improve CLTV

To put it simply, there are two ways to improve CLTV: encourage customers to spend more, more regularly, and encourage them to stick around for longer.

To achieve the former, ensure your service portfolio is on point, develops in response to customer needs, and is competitively priced. Use feedback forms and analyse information from your customers to see if there are complementary services or products you could offer.

The latter is best tackled through strategies that encourage customer retention. Regular contact, feedback, and prompt customer service will all help lower customer churn. A customer who has an established, personal relationship with your company is more likely to stay with you through hard times as well as good.

The Impact of a Recession

Being aware of the value that each customer offers is particularly crucial during a recession. As the world of business struggles with the impact of coronavirus, it's vital to stay on top of your metrics, so you can target sales prospects with a good long term potential CLTV.

When the economy suffers, CLTV can take a hit. Firstly this is because businesses are less willing to spend money and make investment decisions when the economic outlook is uncertain. Secondly, a sudden downturn is a moment when customer retention is in danger. As everyone tries to save money and make economies, customers are more likely to shop around in search of alternative solutions. (This danger recedes after the first few months of a recession. In a longer term downturn, customer retention paradoxically becomes easier as businesses shun the uncertainty of changing supplier – although margins and CLTV may still suffer.)

The Solution to CLTV Uncertainty in a Downturn

The best strategy is to tighten your sales focus. Rather than looking for every new customer you can find, pay attention to those who offer a higher lifetime value. This may be your existing customer base, if they have a high CLTV; you might also use the recession as an opportunity to find new customers who are unhappy with existing services. Be strategic with sales. A prospect with lower order volumes or value but the potential to stay with you a long time may bring you more profit than a large, one-off order.

Ride out the Recession with JDR

Either way, a tight focus on high long term value customers will have a greater payoff than casting your net too widely. Use a business development specialist like JDR to develop bespoke customer retention strategies that work. This way, you will have less risk of losing valuable customers during a financial downturn. If you are looking for new business, be smart. Target carefully, looking for a select few customers who offer a high potential CLTV. Stay on top of your CLTV metrics, and you'll be able to weather any financial storm.

Image source: Unsplash

- Inbound Marketing (SEO, PPC, Social Media, Video) (831)

- Strategy (368)

- Sales & CRM (197)

- Marketing Automation & Email Marketing (190)

- Business Growth (168)

- Website Design (162)

- Hubspot (141)

- Lead Generation (117)

- Google Adwords (100)

- Content Marketing (94)

- Conversion (53)

- Case Studies (49)

- News (47)

- Ecommerce (39)

- Webinars (34)

- SEO (26)

- AI (20)

- Events (19)

- LinkedIn Advertising (17)

- Video (17)

- Video Selling (15)

- Software training (13)

- Niche business marketing (11)

- The Digital Prosperity Podcast (10)

- HubSpot Case Studies (7)

- Facebook Advertising (6)

- Web Design Case Studies (1)

- February 2026 (2)

- January 2026 (12)

- December 2025 (15)

- November 2025 (6)

- October 2025 (17)

- September 2025 (16)

- August 2025 (14)

- July 2025 (14)

- June 2025 (5)

- May 2025 (19)

- April 2025 (15)

- March 2025 (13)

- February 2025 (13)

- January 2025 (8)

- December 2024 (2)

- November 2024 (4)

- October 2024 (21)

- September 2024 (4)

- August 2024 (8)

- July 2024 (14)

- June 2024 (16)

- May 2024 (25)

- April 2024 (15)

- March 2024 (18)

- February 2024 (5)

- January 2024 (10)

- December 2023 (6)

- November 2023 (10)

- October 2023 (13)

- September 2023 (12)

- August 2023 (14)

- July 2023 (13)

- June 2023 (14)

- May 2023 (15)

- April 2023 (13)

- March 2023 (14)

- February 2023 (13)

- January 2023 (15)

- December 2022 (13)

- November 2022 (6)

- October 2022 (8)

- September 2022 (22)

- August 2022 (15)

- July 2022 (13)

- June 2022 (16)

- May 2022 (14)

- April 2022 (16)

- March 2022 (17)

- February 2022 (11)

- January 2022 (8)

- December 2021 (6)

- November 2021 (7)

- October 2021 (11)

- September 2021 (10)

- August 2021 (7)

- July 2021 (7)

- June 2021 (4)

- May 2021 (4)

- April 2021 (1)

- March 2021 (3)

- February 2021 (5)

- January 2021 (4)

- December 2020 (7)

- November 2020 (6)

- October 2020 (5)

- September 2020 (9)

- August 2020 (18)

- July 2020 (17)

- June 2020 (17)

- May 2020 (10)

- April 2020 (21)

- March 2020 (24)

- February 2020 (21)

- January 2020 (12)

- December 2019 (23)

- November 2019 (12)

- October 2019 (14)

- September 2019 (16)

- August 2019 (15)

- July 2019 (13)

- June 2019 (6)

- May 2019 (8)

- April 2019 (4)

- March 2019 (2)

- February 2019 (2)

- January 2019 (2)

- December 2018 (3)

- November 2018 (24)

- September 2018 (11)

- August 2018 (9)

- June 2018 (3)

- May 2018 (6)

- April 2018 (14)

- March 2018 (12)

- February 2018 (16)

- January 2018 (15)

- December 2017 (15)

- November 2017 (18)

- October 2017 (23)

- September 2017 (19)

- August 2017 (28)

- July 2017 (27)

- June 2017 (25)

- May 2017 (18)

- April 2017 (17)

- March 2017 (16)

- February 2017 (17)

- January 2017 (14)

- December 2016 (21)

- November 2016 (27)

- October 2016 (25)

- September 2016 (16)

- August 2016 (20)

- July 2016 (19)

- June 2016 (14)

- May 2016 (20)

- April 2016 (24)

- March 2016 (22)

- February 2016 (28)

- January 2016 (27)

- December 2015 (28)

- November 2015 (19)

- October 2015 (9)

- September 2015 (12)

- August 2015 (5)

- July 2015 (1)

- June 2015 (10)

- May 2015 (3)

- April 2015 (11)

- March 2015 (14)

- February 2015 (15)

- January 2015 (12)

- December 2014 (2)

- November 2014 (23)

- October 2014 (2)

- September 2014 (2)

- August 2014 (2)

- July 2014 (2)

- June 2014 (7)

- May 2014 (14)

- April 2014 (14)

- March 2014 (7)

- February 2014 (2)

- January 2014 (7)

- December 2013 (9)

- November 2013 (14)

- October 2013 (17)

- September 2013 (3)

- August 2013 (6)

- July 2013 (8)

- June 2013 (4)

- May 2013 (3)

- April 2013 (6)

- March 2013 (6)

- February 2013 (7)

- January 2013 (5)

- December 2012 (3)

- November 2012 (2)

- September 2012 (1)

Subscribe by email

You May Also Like

These Related Blogs

Understanding Your Customer Lifetime Value – What You Need to Know

Your customer lifetime value (CLV) is one of the most important metrics to measure when assessing the success of your business activities. Therefore, …

Customer Retention 101: How To Keep Customers

Entrepreneurs know that keeping customers coming back is good for business. Returning customers deliver larger lifetime returns on investment (ROI), a …

Your Guide to Customer Acquisition Costs & Customer Lifetime Value

Would you like to see the return on your marketing investment? Or evaluate how good your sales team are at upselling existing customers? Or even under …