Understanding Your Customer Lifetime Value – What You Need to Know

by Leanne Mordue on 21-Apr-2020 11:58:35

Your customer lifetime value (CLV) is one of the most important metrics to measure when assessing the success of your business activities. Therefore, if you haven't already calculated yours, now is the time to do it. Let's examine what this metric is and how you can utilise it to improve your company's sales revenue.

What Is Your Customer Lifetime Value?

Sometimes referred to as life-time value (LTV) or lifetime customer value (LCV), CLV the amount of net profit that you can expect to make from a customer over the course of your relationship with them. The basic principle is a simple one. If a client is loyal to your company for ten years, for example, and your annual net profit from that customer is £25k, their CLV will be £250k. If you operate a company where clients' pay you set amounts at regular intervals, it's easier to work out your CLV, but you can still estimate it if your sales pattern isn't as predictable.

If you want to calculate your historic CLV more accurately or predict what it's likely to be in future, there are formulas that you can use. You'll need access to data about your business, such as your average profit margin per sale, your customer acquisitions costs, the average length of your customer relationships, your average transaction spend and more. If you work with professional business growth specialists, such as JDR, they'll be able to guide you through the process.

What Benefits Could Knowing Your CLV Bring?

If you know your CLV, you can assess the success of your marketing activities more accurately and make well-informed decisions about your expenditure. For example, if you engage in an inbound marketing campaign that costs you £1 per customer that you acquire and each product you sell nets you a profit of £0.75, it will seem like you've made a loss. However, if your CLV is £100, that campaign suddenly becomes a success.

What's more, once you've calculated your CLV, you can take steps to improve it – and that could dramatically affect the profit you make. You might want to implement a loyalty programme, for example, to increase the length of your customer relationships, or focus more on upselling and cross-selling your products and services, so you can increase the number of customer transactions. You could also launch email marketing campaigns to persuade customers who haven't engaged with you recently to buy from you again, or direct them to content that might interest them on your website. It's also worth examining your customer support and retention processes to ensure that the customer service you're providing isn't causing you to lose repeat sales.

Find Out More

To find out more about how your CLV can benefit your business, get in touch . We can help you increase your average CLV and use it to create a marketing plan that delivers, as well as assist you with your calculations.

Image source: Pixabay

- Inbound Marketing (SEO, PPC, Social Media, Video) (831)

- Strategy (368)

- Sales & CRM (197)

- Marketing Automation & Email Marketing (190)

- Business Growth (168)

- Website Design (162)

- Hubspot (141)

- Lead Generation (117)

- Google Adwords (100)

- Content Marketing (94)

- Conversion (53)

- Case Studies (49)

- News (47)

- Ecommerce (39)

- Webinars (34)

- SEO (26)

- AI (20)

- Events (19)

- LinkedIn Advertising (17)

- Video (17)

- Video Selling (15)

- Software training (13)

- Niche business marketing (11)

- The Digital Prosperity Podcast (10)

- HubSpot Case Studies (7)

- Facebook Advertising (6)

- Web Design Case Studies (1)

- February 2026 (2)

- January 2026 (12)

- December 2025 (15)

- November 2025 (6)

- October 2025 (17)

- September 2025 (16)

- August 2025 (14)

- July 2025 (14)

- June 2025 (5)

- May 2025 (19)

- April 2025 (15)

- March 2025 (13)

- February 2025 (13)

- January 2025 (8)

- December 2024 (2)

- November 2024 (4)

- October 2024 (21)

- September 2024 (4)

- August 2024 (8)

- July 2024 (14)

- June 2024 (16)

- May 2024 (25)

- April 2024 (15)

- March 2024 (18)

- February 2024 (5)

- January 2024 (10)

- December 2023 (6)

- November 2023 (10)

- October 2023 (13)

- September 2023 (12)

- August 2023 (14)

- July 2023 (13)

- June 2023 (14)

- May 2023 (15)

- April 2023 (13)

- March 2023 (14)

- February 2023 (13)

- January 2023 (15)

- December 2022 (13)

- November 2022 (6)

- October 2022 (8)

- September 2022 (22)

- August 2022 (15)

- July 2022 (13)

- June 2022 (16)

- May 2022 (14)

- April 2022 (16)

- March 2022 (17)

- February 2022 (11)

- January 2022 (8)

- December 2021 (6)

- November 2021 (7)

- October 2021 (11)

- September 2021 (10)

- August 2021 (7)

- July 2021 (7)

- June 2021 (4)

- May 2021 (4)

- April 2021 (1)

- March 2021 (3)

- February 2021 (5)

- January 2021 (4)

- December 2020 (7)

- November 2020 (6)

- October 2020 (5)

- September 2020 (9)

- August 2020 (18)

- July 2020 (17)

- June 2020 (17)

- May 2020 (10)

- April 2020 (21)

- March 2020 (24)

- February 2020 (21)

- January 2020 (12)

- December 2019 (23)

- November 2019 (12)

- October 2019 (14)

- September 2019 (16)

- August 2019 (15)

- July 2019 (13)

- June 2019 (6)

- May 2019 (8)

- April 2019 (4)

- March 2019 (2)

- February 2019 (2)

- January 2019 (2)

- December 2018 (3)

- November 2018 (24)

- September 2018 (11)

- August 2018 (9)

- June 2018 (3)

- May 2018 (6)

- April 2018 (14)

- March 2018 (12)

- February 2018 (16)

- January 2018 (15)

- December 2017 (15)

- November 2017 (18)

- October 2017 (23)

- September 2017 (19)

- August 2017 (28)

- July 2017 (27)

- June 2017 (25)

- May 2017 (18)

- April 2017 (17)

- March 2017 (16)

- February 2017 (17)

- January 2017 (14)

- December 2016 (21)

- November 2016 (27)

- October 2016 (25)

- September 2016 (16)

- August 2016 (20)

- July 2016 (19)

- June 2016 (14)

- May 2016 (20)

- April 2016 (24)

- March 2016 (22)

- February 2016 (28)

- January 2016 (27)

- December 2015 (28)

- November 2015 (19)

- October 2015 (9)

- September 2015 (12)

- August 2015 (5)

- July 2015 (1)

- June 2015 (10)

- May 2015 (3)

- April 2015 (11)

- March 2015 (14)

- February 2015 (15)

- January 2015 (12)

- December 2014 (2)

- November 2014 (23)

- October 2014 (2)

- September 2014 (2)

- August 2014 (2)

- July 2014 (2)

- June 2014 (7)

- May 2014 (14)

- April 2014 (14)

- March 2014 (7)

- February 2014 (2)

- January 2014 (7)

- December 2013 (9)

- November 2013 (14)

- October 2013 (17)

- September 2013 (3)

- August 2013 (6)

- July 2013 (8)

- June 2013 (4)

- May 2013 (3)

- April 2013 (6)

- March 2013 (6)

- February 2013 (7)

- January 2013 (5)

- December 2012 (3)

- November 2012 (2)

- September 2012 (1)

Subscribe by email

You May Also Like

These Related Blogs

4 Ways To Improve Your Blog Article Conversion Rates

A blog aims to inform its readers by giving a high quality, ethical, and valuable insight into your company's product or service, and overall brand. T …

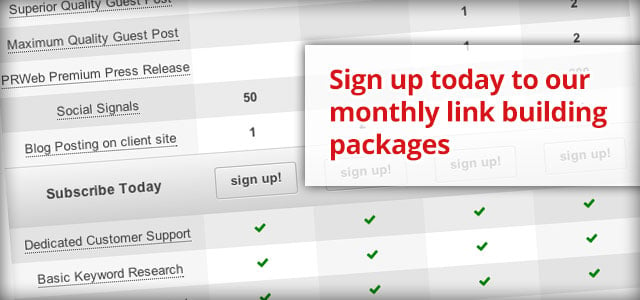

How Can I See What Links My SEO Company Is Building?

Do you ever feel that your SEO Company are not building enough links or you just want to be able to see them? Do you think that the links they are bui …

A Beginners Guide to Your Company's Unique Selling Proposition (USP)

Creating a unique selling proposition (USP) is critical to a business for a number of reasons. For one thing, it’s important because it communicates t …