Should I Invest In My Business When Interest Rates & Inflation Are High?

by Leanne Mordue on 10-Aug-2023 12:30:00

Investing in your business when interest rates and inflation are high can be a complex decision, as it depends on various factors. High-interest rates can impact a company’s ability to invest in growth and innovation since the cost of borrowing money becomes more expensive. Inflation also plays a crucial role in any investment decision, as persistent inflation can affect a business’s ability to meet its financial goals and puts pressure on production overheads and wages.

Does this mean that businesses should hold tight on hiring new people, purchasing new machinery, and investing in marketing until interest rates and inflation have stabilised? Not necessarily, and in many ways, the same rules apply to business investments during high inflation and interest as they do when these rates are lower.

The Varying Impact Of Inflation And Interest Rates

It’s important to note that high inflation and interest don’t impact all businesses and sectors equally. Established businesses with a positive cash flow, for example, may stand to benefit from rising interest rates, as it gives them the capability of investing their positive cash flow into higher-yielding investment strategies, such as automation, new technologies, and marketing/sales. Equally, some sectors may even benefit from rising interest rates as this can lead to a slowdown of growth, which in turn helps control inflation, reducing wage pressure and operating costs. Most specialists generally advise against long-term fixed-income investments during periods of inflation, in favour of investments with the potential for increasing or above-inflation returns.

How Does This Apply To Marketing And Sales?

Given the complexity of current economic conditions, we recommend consulting with a qualified financial adviser and conducting thorough independent research before making any major investment decision for your business.

One thing we can say with confidence is that for many businesses, the marketing and sales budget is the first to take a hit when operating costs rise. This is unfortunate because investing in growth is the proven best way of navigating periods of economic uncertainty and laying the foundations for renewed growth when conditions stabilise.

Marketing is an investment in your long-term future growth and prosperity, so like an investment in plant, machinery, or property, is worthy of careful consideration. If you are borrowing money to finance your marketing, high-interest rates could make your strategy more expensive and put pressure on your budget, while inflation may increase the cost of marketing services and materials.

Despite these potential challenges, however, there are strong reasons why investing in marketing during uncertain times is beneficial.

- Firstly, sustained investment in marketing through rain or shine can help your business maintain or boost its market share during tough economic times, helping you stay connected with your customers, understand their changing needs, and adjust your offerings accordingly.

- Secondly, investing in marketing while others are cutting back on their marketing efforts due to increased costs might give you an important competitive edge, helping your business stand out as a strong and resilient service provider.

Forecasting Costs And ROI

Before making any investment, it’s important to forecast your costs and returns over the period of your investment. During previous recessions, increased interest and inflation sometimes reduced the expected ROI from marketing by increasing costs and mitigating returns. However, important technological advances in marketing technology, including automation software, social media, digital collaboration tools, and analytics, have dramatically increased the potential returns from digital marketing activities, so that a positive ROI is achievable within a short timeframe, despite high inflation and interest.

Find Out More

Our experienced marketing team can help you develop a personalised business case for digital marketing, supporting you to define your marketing goals, identifying key metrics for success, estimating your marketing costs, and forecasting your results and ROI. To find out more, please get in touch today.

Image Source: Canva

- Inbound Marketing (SEO, PPC, Social Media, Video) (831)

- Strategy (368)

- Sales & CRM (197)

- Marketing Automation & Email Marketing (190)

- Business Growth (168)

- Website Design (162)

- Hubspot (141)

- Lead Generation (117)

- Google Adwords (100)

- Content Marketing (94)

- Conversion (53)

- Case Studies (49)

- News (47)

- Ecommerce (39)

- Webinars (34)

- SEO (26)

- AI (20)

- Events (19)

- LinkedIn Advertising (17)

- Video (17)

- Video Selling (15)

- Software training (13)

- Niche business marketing (11)

- The Digital Prosperity Podcast (10)

- HubSpot Case Studies (7)

- Facebook Advertising (6)

- Web Design Case Studies (1)

- February 2026 (2)

- January 2026 (12)

- December 2025 (15)

- November 2025 (6)

- October 2025 (17)

- September 2025 (16)

- August 2025 (14)

- July 2025 (14)

- June 2025 (5)

- May 2025 (19)

- April 2025 (15)

- March 2025 (13)

- February 2025 (13)

- January 2025 (8)

- December 2024 (2)

- November 2024 (4)

- October 2024 (21)

- September 2024 (4)

- August 2024 (8)

- July 2024 (14)

- June 2024 (16)

- May 2024 (25)

- April 2024 (15)

- March 2024 (18)

- February 2024 (5)

- January 2024 (10)

- December 2023 (6)

- November 2023 (10)

- October 2023 (13)

- September 2023 (12)

- August 2023 (14)

- July 2023 (13)

- June 2023 (14)

- May 2023 (15)

- April 2023 (13)

- March 2023 (14)

- February 2023 (13)

- January 2023 (15)

- December 2022 (13)

- November 2022 (6)

- October 2022 (8)

- September 2022 (22)

- August 2022 (15)

- July 2022 (13)

- June 2022 (16)

- May 2022 (14)

- April 2022 (16)

- March 2022 (17)

- February 2022 (11)

- January 2022 (8)

- December 2021 (6)

- November 2021 (7)

- October 2021 (11)

- September 2021 (10)

- August 2021 (7)

- July 2021 (7)

- June 2021 (4)

- May 2021 (4)

- April 2021 (1)

- March 2021 (3)

- February 2021 (5)

- January 2021 (4)

- December 2020 (7)

- November 2020 (6)

- October 2020 (5)

- September 2020 (9)

- August 2020 (18)

- July 2020 (17)

- June 2020 (17)

- May 2020 (10)

- April 2020 (21)

- March 2020 (24)

- February 2020 (21)

- January 2020 (12)

- December 2019 (23)

- November 2019 (12)

- October 2019 (14)

- September 2019 (16)

- August 2019 (15)

- July 2019 (13)

- June 2019 (6)

- May 2019 (8)

- April 2019 (4)

- March 2019 (2)

- February 2019 (2)

- January 2019 (2)

- December 2018 (3)

- November 2018 (24)

- September 2018 (11)

- August 2018 (9)

- June 2018 (3)

- May 2018 (6)

- April 2018 (14)

- March 2018 (12)

- February 2018 (16)

- January 2018 (15)

- December 2017 (15)

- November 2017 (18)

- October 2017 (23)

- September 2017 (19)

- August 2017 (28)

- July 2017 (27)

- June 2017 (25)

- May 2017 (18)

- April 2017 (17)

- March 2017 (16)

- February 2017 (17)

- January 2017 (14)

- December 2016 (21)

- November 2016 (27)

- October 2016 (25)

- September 2016 (16)

- August 2016 (20)

- July 2016 (19)

- June 2016 (14)

- May 2016 (20)

- April 2016 (24)

- March 2016 (22)

- February 2016 (28)

- January 2016 (27)

- December 2015 (28)

- November 2015 (19)

- October 2015 (9)

- September 2015 (12)

- August 2015 (5)

- July 2015 (1)

- June 2015 (10)

- May 2015 (3)

- April 2015 (11)

- March 2015 (14)

- February 2015 (15)

- January 2015 (12)

- December 2014 (2)

- November 2014 (23)

- October 2014 (2)

- September 2014 (2)

- August 2014 (2)

- July 2014 (2)

- June 2014 (7)

- May 2014 (14)

- April 2014 (14)

- March 2014 (7)

- February 2014 (2)

- January 2014 (7)

- December 2013 (9)

- November 2013 (14)

- October 2013 (17)

- September 2013 (3)

- August 2013 (6)

- July 2013 (8)

- June 2013 (4)

- May 2013 (3)

- April 2013 (6)

- March 2013 (6)

- February 2013 (7)

- January 2013 (5)

- December 2012 (3)

- November 2012 (2)

- September 2012 (1)

Subscribe by email

You May Also Like

These Related Blogs

Is Brexit Holding You Back From Achieving Your Sales Objectives?

Between Brexit and Covid, UK businesses have had their fair share of uncertainty over the past year or so. And while the end is in sight for Covid res …

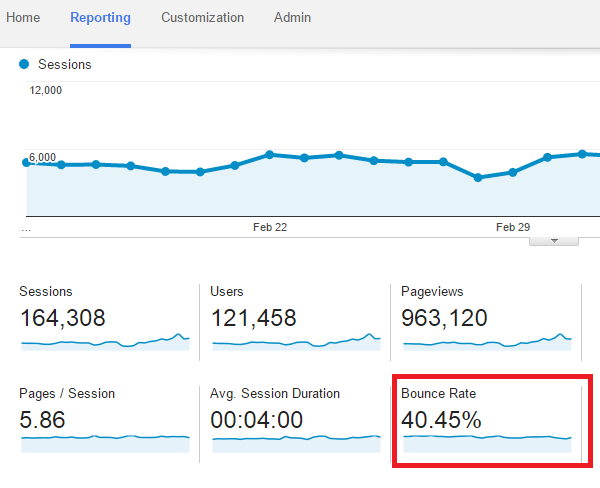

What Is Google Analytics Bounce Rate & How To Reduce It

Your Bounce Rate is a good indication of how successful or unsuccessful your webpages are at capturing a visitor’s interest. By analysing the bounce r …

Why Inbound Marketing Is Essential For Small Business Growth

Inbound marketing has become the leading digital growth strategy for businesses of all sizes, effectively supplanting outbound sales by using search m …